You log into your trading platform and the naira has slipped again overnight, spreads widened, and your stop was taken out on a trade that looked solid five minutes earlier. That brutal mix of local currency swings, irregular liquidity and intermittent connectivity means traditional recipes for profit rarely work unchanged in Nigeria. Understanding how Forex reacts to on‑the‑ground frictions is the difference between repeated frustration and consistent edge.

Trading success here starts with matching strategy to real constraints: time available, capital size, execution lag and personal tolerance for drawdown. Short‑term scalps that ignore execution risk bite hard; long‑term positional ideas can fail when interest and sentiment flip fast. Expect concrete ways to adapt entries, exits, position sizing and risk management so strategies survive the realities of Nigerian markets without relying on luck.

Forex market basics for Nigerian traders

Foreign exchange trading boils down to buying one currency while selling another. For Nigerian traders, that simple definition hides practical quirks: local liquidity, regulatory nuance, and the influence of FX policies and oil-price swings on the naira. Understand the core building blocks first; they determine position sizing, risk, and how much a pip movement actually affects your Naira balance.

Currency pair: A quotation of two currencies showing how much of the quote currency is needed to buy one unit of the base currency.

Pip: The smallest standard price move in a currency pair, usually the fourth decimal place (0.0001) for most major pairs; for pairs involving the Japanese yen it’s the second decimal (0.01).

Lot size: The standardized trading quantity. A standard lot is 100,000 units, a mini lot is 10,000 units, and a micro lot is 1,000 units.

Leverage: A broker-provided ratio that multiplies trading exposure relative to margin (e.g., 1:100 means ₦1,000 margin controls ₦100,000 notional).

Spread: The difference between the bid and ask price; the immediate transaction cost captured by brokers or liquidity providers.

Common forex concepts and their practical impact for Nigerian traders (term vs. impact vs. local example)

| Concept | Definition | Practical impact | Nigeria-specific example |

|---|---|---|---|

| Currency pair | Quote expressing relative value between two currencies | Determines which economies and macro news drive moves | USD/NGN reacts strongly to CBN policy and FX window liquidity |

| Pip | Smallest quoted price increment | Used to calculate profit/loss and risk per trade | A 10-pip move on EUR/USD translates to USD value that must be converted to NGN |

| Lot size | Standard contract volume (standard/mini/micro) | Directly scales pip value and margin required | Trading micro lots reduces NGN exposure when naira volatility spikes |

| Leverage | Borrowed capital multiplier | Amplifies gains and losses; higher leverage raises liquidation risk | Local brokers often offer 1:50–1:200 depending on regulation and account type |

| Spread | Bid–ask difference | Immediate cost on entry/exit; wider spreads hurt short-term strategies | During market stress, spreads widen on NGN crosses and exotics |

Market drivers in Nigeria deserve special attention: Oil prices: Major influence on budget receipts and naira sentiment. CBN policy: Direct impact on liquidity and official FX windows. * FX reserves & external flows: Drive available USD liquidity and informal market spreads.

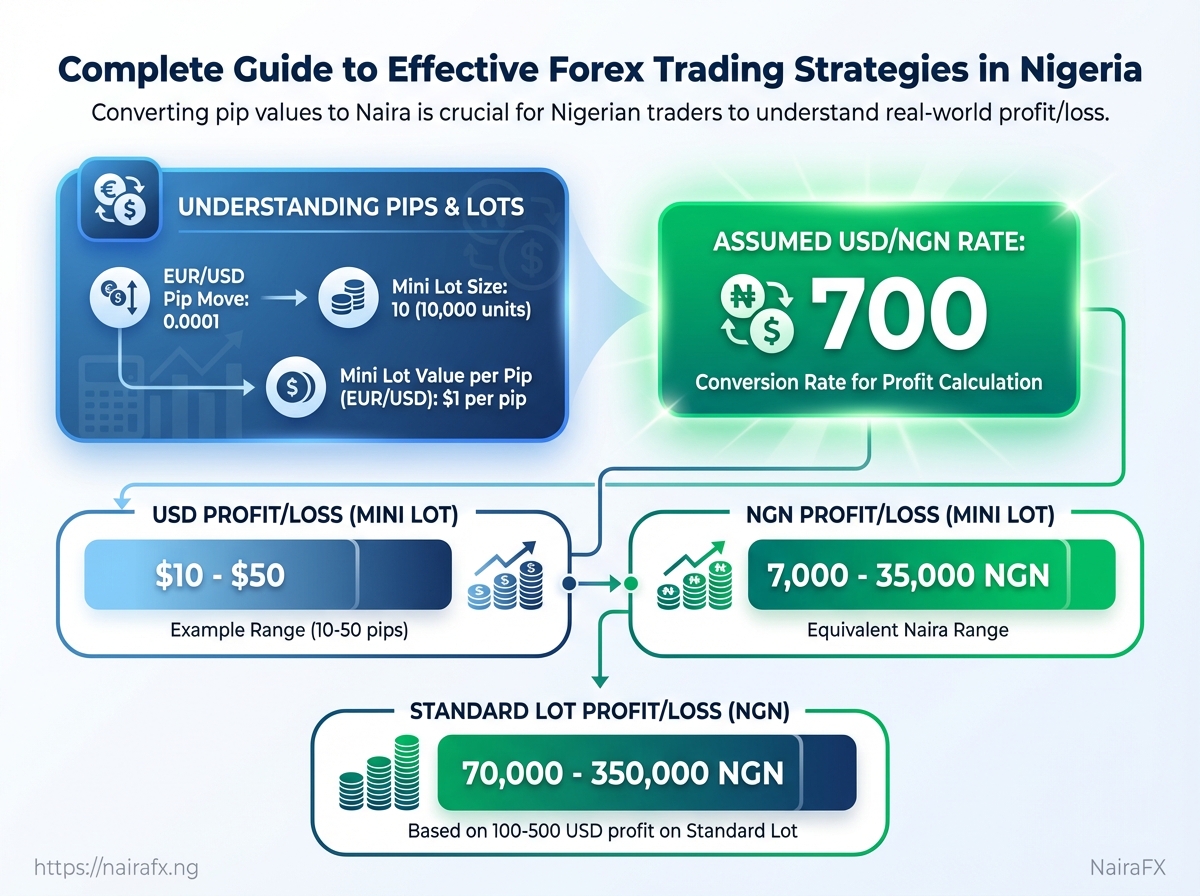

Practical example — converting pips to NGN (concrete steps)

- Assume

EUR/USDmoves 10 pips and you trade a mini lot (10,000 units). - Pip value for

EUR/USDon a mini lot ≈10,000 × 0.0001 = 1 USDper pip, so 10 pips =10 USD. - Convert USD to NGN using the prevailing rate; if

USD/NGN ≈ ₦800, then10 USD × ₦800 = ₦8,000. - If you used higher leverage or a larger lot, multiply proportionally; a standard lot would be

₦80,000for the same 10-pip move.

Traders in Nigeria should run these simple calculations before sizing any trade to match local income, capital availability, and the naira’s volatility. Getting pip-to-NGN math right keeps risk realistic and positions aligned with your objectives.

Proven strategy frameworks

Trend-following and breakout systems remain the most practical frameworks for Nigerian traders who want clear rules, manageable risk, and strategies that adapt to volatile FX and local market moves. Both approaches rely on momentum confirmation rather than predicting reversals, which fits markets where directional swings can be sharp and sudden.

Trend-following: indicators and parameter suggestions

- Moving averages: Use a dual setup —

50 EMA(medium) and200 EMA(long). A bullish signal occurs when the50 EMAcrosses above the200 EMAand price stays above both for at least three candles on your chosen timeframe. - ADX:

ADX > 20confirms trend strength; prefer>25for cleaner entries. - Trend filter: Use daily timeframe for direction, 4-hour for entries, 1-hour for execution.

Breakout strategies: indicators and parameter suggestions

- Volatility filter:

ATR(14)as a volatility scaler; require breakout to exceed1.5 × ATRrelative to the range. - Breakout confirmation: Wait for a close beyond the breakout level and a retest that holds as new support/resistance.

- Timeframe: Use 1-hour and 4-hour for intraday/position entries; avoid using 5–15 minute breakouts in thin NGN liquidity windows.

Example trade plan and stop rules

- Identify trend on daily (

50/200 EMAalignment) and mark nearest consolidation range on 4-hour. - Wait for price to close beyond range by

>1.5 × ATR(14)on 4-hour. - Enter on retest hold above the breakout level with a momentum candle.

- Place stop-loss

1–1.5 × ATR(14)below the retest low. - Scale out: take 50% at

1×risk-to-reward, trail remaining with50 EMAon 4-hour or a2× ATRtrailing stop.

How to avoid false breakouts in volatile NGN context

- Liquidity awareness: Avoid major local holiday sessions and thin offshore hours when NGN pairs may gap.

- Confirm with volume or tick activity: A true breakout usually has increased volume or tick rate; weak tick counts suggest a fake.

- Use multi-timeframe confirmation: Only trade breakouts that align with daily trend and have 4-hour retest validation.

- Smaller position sizing: Reduce contract size when ATR spikes above recent historical median.

Trend-following vs breakout setups: indicators used, ideal market, timeframe, entry rule, exit rule

Trend-following vs breakout setups: indicators used, ideal market, timeframe, entry rule, exit rule

| Strategy | Indicators/Tools | Ideal market | Timeframe | Entry rule | Exit rule |

|---|---|---|---|---|---|

| Trend following | 50/200 EMA, ADX, ATR |

Strong directional trends | Daily/4H/1H | EMA cross + ADX>20 + retest | Trail with 50 EMA or ATR-based trailing |

| Breakout | Range, ATR(14), volume/tick |

Trending or range-break markets | 4H/1H | Close > range by 1.5×ATR + retest |

Fixed R:R or trailing after first target |

| Mean reversion | RSI(14), Bollinger Bands | Choppy mean-reverting markets | 1H/15m | Extremes (RSI>70/RSI<30) at BB edges | Tight fixed SL; target mid-band |

| Carry trade | Interest rate differential, swap rates | Low volatility, stable trends | Daily/Weekly | Position on positive carry + trend bias | Monitor interest changes; wide SL for macro events |

| Event-driven | Economic calendar, implied vol | News-sensitive markets | Intraday/Daily | Trade confirmed break after volatility settles | Close before next scheduled event |

Key insight: Trend-following and breakout frameworks work because they trade what the market is doing, not what it might do next. For Nigerian traders, combining volatility-aware filters (ATR, ADX), multi-timeframe confirmation, and conservative sizing around low-liquidity windows significantly reduces false signals and preserves capital.

These frameworks are practical, adaptable, and purpose-built for environments with sharp moves and liquidity quirks—apply them with discipline and tune the parameters to live NGN pair behavior for better results.

Risk management and capital preservation

Position sizing, stop placement and scenario planning are what keep a trading account alive through bad runs. Use a clear, repeatable sizing rule, set stops that respect both volatility and structure, and prepare contingency rules for policy shocks or sudden liquidity drains.

Position sizing fundamentals

Use a fixed-percentage risk of account equity per trade. A practical formula is Position size = Risk amount / (Stop distance Pip value). Choose risk per trade: Typical ranges are 0.5%–2% of equity. Convert risk to currency: Risk amount = Account size × Risk%. Express position in lots/units using your broker’s pip-value convention.

Stops: volatility + structure

Set stops where price invalidates the trade idea, then check volatility. A robust approach combines structural levels and ATR: calculate a preliminary stop at nearby swing high/low, then adjust using ATR. For example, Stop = Structural level ± (ATR × 1.5–2). That keeps stops wide enough for normal noise but close enough to limit losses.

Scenario planning: contingency rules

- Close a portion: Partial exit: Reduce exposure by 50% if a central bank statement causes a 1% pair gap.

- Volatility halt: Hold flat rule: Stop opening new positions when realized volatility exceeds 2× monthly ATR.

- Policy-event buffer: Event-size scaling: Reduce normal risk-per-trade by half in the 24 hours around known policy announcements.

Practical tips: when NGN liquidity is thin, widen stops modestly instead of increasing lot size; prefer unit-based position sizing rather than fixed lots. Record every shock and how the plan performed—this builds a usable contingency library.

Sample position-sizing outputs for different account sizes and risk percentages in NGN

Assumptions: pip value per micro‑lot (1,000 units) = NGN10; 1 standard lot = 100 micro‑lots. All rows use 1% risk and a 50‑pip stop for clarity.

| Account size (NGN) | Risk per trade (%) | Risk amount (NGN) | Stop distance (pips) | Position size (lots/units) |

|---|---|---|---|---|

| 50,000 NGN | 1% | 500 NGN | 50 pips | 1 micro‑lot → 0.01 lot |

| 200,000 NGN | 1% | 2,000 NGN | 50 pips | 4 micro‑lots → 0.04 lot |

| 1,000,000 NGN | 1% | 10,000 NGN | 50 pips | 20 micro‑lots → 0.20 lot |

| 5,000,000 NGN | 1% | 50,000 NGN | 50 pips | 100 micro‑lots → 1.00 lot |

| 10,000,000 NGN | 1% | 100,000 NGN | 50 pips | 200 micro‑lots → 2.00 lots |

Key insight: Small accounts require micro‑lot sizing and strict per‑trade risk; larger accounts scale linearly but must still respect market liquidity and stop placement to avoid catastrophic drawdowns.

Applying these rules consistently—with documented contingency steps for policy shocks—keeps risk measurable and survival odds higher during Nigeria’s volatile sessions. Stick to the math, and let scenario plans guide decisions when the market gets noisy.

📝 Test Your Knowledge

Take this quick quiz to reinforce what you’ve learned.

Trade execution, psychology, and journaling

Clean execution and steady nerves are what separate repeatable traders from hobbyists. Execution mechanics are about choosing the right order type, managing slippage and latency, and automating safety rules. Trader discipline is the daily habit loop that ensures those mechanics actually get used. Journaling ties them together — it makes behavioral patterns visible and strategies improvable.

Order types: Market — immediate fill at current price; Limit — fill at a specific price or better; Stop — triggers an order when a price is reached; OCO — one cancels the other for paired risk management.

Slippage: The difference between expected execution price and actual fill price. Slippage grows in illiquid markets, at news, or on large order sizes.

Execution mechanics — practical points Use the right order type: Market orders for small, time-sensitive trades; limit orders for planned entries/exits to control price. Size to liquidity: Break large orders into iceberg or child orders to avoid market impact. Predefine slippage tolerance: Set maximum acceptable slippage (e.g., ±0.3%) depending on pair volatility. Reduce latency where it matters: Use a reliable broker and colocated VPS for automated strategies during volatile Nigerian session hours.

Daily/weekly routine aligned with Nigerian sessions Morning check (06:30–08:30 WAT): News scan, position notes, set open orders. Pre-session setup (08:30–09:30 WAT): Confirm liquidity and spreads, cancel stale orders. Mid-day review (12:00–14:00 WAT): Re-assess open trades; tighten stops if needed. End-of-day wrap (16:30–18:00 WAT): Record outcomes and emotional state; prepare plan for next session. * Weekly review (Friday evening): Evaluate performance, adjust position sizing for upcoming week.

Practical journaling template and review rules 1. Record basic trade data: instrument, direction, size, order type, entry, stop, target, and slippage.

- Record context: thesis in one sentence, time of day, liquidity note, and any news or macro factors.

- Record process & psychology: pre-trade checklist passed? Confidence 1–10. Emotional state (calm, anxious, rushed).

- Post-trade analysis: outcome, deviations from plan, and one improvement to test next week.

Review discipline rules Weekly: Tag repeating mistakes and test one corrective rule. Monthly: Calculate expectancy and win-rate by setup. * Quarterly: Use equity-curve review to adjust position-sizing limits.

A concise, disciplined execution flow and a brutal-yet-constructive journaling habit turn random outcomes into predictable edges. Keep the mechanics tight, the routine simple, and the journal honest — that’s where consistent edge lives.

Tools, platforms, and data sources

For active traders in Nigeria, the choice of brokers, charting platforms, and news feeds shapes everything from execution quality to how reliably a strategy scales. Pick a broker that actually lets you move Naira in and out with reasonable cost; pick charting tools that save time in analysis; and pick news feeds that match the time-sensitivity of your approach. Below are practical selection points, examples, and integration options to get a trading stack that works in Nigeria’s market reality.

Broker selection checklist (Nigeria-specific)

- Regulation & legal fit: Confirm onshore or internationally recognized regulation and whether the broker legally accepts Nigerian clients.

- NGN funding support: Check for direct Naira deposits or trusted local payment partners to avoid costly FX conversions.

- Withdrawal reliability: Read recent user reviews focused on payout timelines and AML hold behavior.

- Execution & spreads: Look at live spreads during your trading hours (Nigerian market hours or your session).

- Customer support: Ensure 24/5 support with Nigerian-friendly channels (WhatsApp, local phone).

- Local tax / compliance guidance: Prefer brokers that provide documentation usable for Nigerian tax reporting.

- Platform & API access: Confirm MT4/MT5, TradingView, or REST/WebSocket APIs for automation.

Top charting and data tools — one-line pros/cons

- TradingView: Pros: fast web charts, huge indicator library; Cons: higher-cost plans for real-time FX/level-2.

- MetaTrader 4/5: Pros: mature EA ecosystem and broker integration; Cons: dated UI, limited multi-asset depth.

- cTrader: Pros: robust order types and FIX-like execution; Cons: smaller broker coverage.

- Bloomberg/Refinitiv (institutional): Pros: deepest data and news; Cons: cost-prohibitive for retail.

- Local market news feeds: Pros: on-the-ground FX flow signals; Cons: variable reliability — vet the vendor.

Automation and API options for strategy traders

- Confirm broker API type (REST, FIX, WebSocket) and whether it supports live trading, backtesting, and sandbox accounts.

- Test latency: run a simple round-trip request/response to estimate execution latency from your VPS in Lagos or Abuja.

- Set secure credential rotation and logging; avoid storing credentials in plain text.

Side-by-side comparison of recommended platforms/brokers and charting tools with key attributes relevant to Nigerian traders

| Platform/Broker | Regulation | Funding options (NGN/naira support) | Spreads/Fees | Best for |

|---|---|---|---|---|

| Broker A (FXTM) | FCA, CySEC (regional) | NGN via local partners, cards, e-wallets | Typical spreads from 0.6 pips | Beginners, Naira deposits |

| Broker B (IG) | FCA, ASIC | Card, bank transfer; NGN via third-party processors | Competitive spreads; per-trade fees on some products | Professional traders, research |

| OANDA | FCA, CFTC, IIROC | Cards, bank transfers; NGN via local gateways in regions | Variable spreads; transparent fee structure | FX-focused traders |

| TradingView | US/Global entity (data partners) | N/A (charting SaaS) | Free tier; Pro from ~$14.95/mo | Social charting & idea sharing |

| MetaTrader 4/5 | Platform standard (broker-regulated) | Depends on broker (many support NGN via broker partners) | Broker-dependent spreads & commissions | Algorithmic EAs and retail automation |

| cTrader | Broker-integrated regulation varies | Card, bank transfer via brokers; NGN support varies | Low-latency ECN spreads | Execution-sensitive traders |

| Local payment gateways (e.g., Paystack/Flutterwave partners) | Nigerian PSP regs | Direct NGN processing, card, USSD, bank transfer | Gateway fees + FX conversion fees | Fast deposits/withdrawals for local clients |

| Refinitiv/Bloomberg (data) | Institutional regulation | N/A (data terminals/subscriptions) | High subscription cost | Institutional-grade news & data |

Key insight: Brokers with clear NGN funding routes and responsive local support reduce operational friction more than marginally tighter spreads; pairing a reliable broker (with API) and a flexible charting tool like TradingView or MT5 gives most traders a practical, automatable stack.

Choosing the right mix matters more than chasing tiny spread differences — especially when local funding, withdrawal reliability, and API access determine whether a strategy actually runs in production.

📥 Download: Forex Trading Strategy Checklist for Nigerian Traders (PDF)

Case studies, templates, and quick reference cheat sheet

Two short, realistic trade logs and a compact cheat sheet make strategy improvements immediate and repeatable. Below are concise case studies that expose how plan design, position sizing, and execution interact, followed by plug-and-play templates and a day-to-day cheat sheet you can copy into your journal.

Contrast two case studies: setup, trade plan, execution, outcome, and lessons learned

| Case | Strategy | Entry/Exit | Position size | Outcome | Key lesson |

|---|---|---|---|---|---|

| Trend-following win | Trend-following on EUR/USD using 50-200 EMA crossover | Entry: 1.0900 after 50 EMA crossed above 200 EMA Exit: 1.1180 when price closed below 50 EMA |

2% equity risk, stop 1.0840 (60 pips), target trailing 80 pips | +2.7% net after spread & slippage | Trade rode momentum; trailing stop protected gains and converted a swing into a winning position |

| Event-driven loss | Short USD/NGN ahead of surprise FX policy announcement | Entry: 780.00 on volatility breakout Exit: 794.50 stop hit after central bank statement |

3% equity risk, stop 14.5 NGN, no hedge | -3.1% net due to sharp policy-driven gap | Event risk underestimated; liquidity evaporated—always size down or pause before scheduled macro events |

| Breakout example | GBP/USD breakout from multi-week consolidation | Entry: 1.2525 on 15-min breakout with 2x average volume | Exit: 1.2690 partial, 1.2750 final; stop 1.2460 | +1.9% net, partial-taking locked profits | Volume confirmation and staged exits improved final outcome and reduced emotional decisions |

| Mean reversion example | Short AUD/USD after RSI(14) > 78 during flat market | Entry: 0.7120 near resistance, tight stop | Exit: 0.7055 target hit | +0.8% net with small position | Works in low-volatility regimes; avoid in trending markets—confirm with ADX < 20 |

| Summary lessons | Plan, size, execute, review | Use stop, target, and context for every trade | Size relative to event risk | Outcomes vary; journaling reveals systematic edges | Consistent review turns edge into expectancy |

Key insight: the differences between wins and losses often come down to event sizing, exit discipline, and context confirmation—small adjustments in these areas compound quickly into large improvements.

Downloadable templates and quick tools: Trade plan template: fields for objective, timeframe, entry, stop, target, risk %, and pre-trade checklist. Journaling template: date, pair, timeframe, screenshots, emotional state, outcome, lessons. Quick reference cheat sheet: common risk% rules (1%–3%), position-sizing formula position = (equity risk%) / stop_pips, and event pause list.

- Create a copy of the trade plan and journaling templates.

- Fill them before every trade—no exceptions.

- Review weekly and feed results into Monte Carlo or equity-curve checks (NairaFX’s Monte Carlo simulation is useful here).

This package moves abstract rules into everyday practice so decisions stay disciplined and repeatable. Use the templates for one month and observe how patterns in your journal point directly to the next tweak.

Conclusion

You’ve now got a practical map: understand how Nigerian FX moves, apply a proven strategy framework, protect capital with tight risk rules, and keep a disciplined execution and journaling habit. Those elements aren’t optional — they stack. Remember the Lagos retail trader who cut drawdowns by switching to fixed fractional sizing and the small FX desk that avoided large losses after enforcing a hard daily stop; both changed one thing at a time and let process beat emotion. Carry that mindset: trade plans that define entry, size, and stop; a routine that forces a pre-trade checklist; and a simple journal that turns mistakes into repeatable lessons.

Start with three concrete steps: audit one recent trade against your execution checklist, set a firm position-size rule for your next five trades, and build a two-minute end-of-day journal entry noting why you entered and what you’d change. For tools, see the platform guides at NairaFX if professional templates or coaching would speed implementation. If questions linger about sizing or when to widen stops, test ideas on a micro account and let outcomes—not opinions—decide. Do that, and the next time the naira gaps and spreads blow out, your process will be the calm in the room.