Most traders check prices first thing and still feel like they’re guessing why a coin just doubled or crashed overnight. The truth is that cryptocurrency markets weave technical signals, social momentum, and regulatory noise together so tightly that traditional market instincts often misfire. Recognising which of those forces is driving a move separates reactive losers from traders who make repeatable decisions.

Volatility here isn’t a nuisance—it’s the raw material for profit, but only when treated with a framework rather than hope. Learn how liquidity pockets form, why on‑chain metrics matter alongside order books, and how macro headlines compress or amplify moves, and the market’s chaos starts to look like a set of patterns you can trade around.

Executive Summary

Crypto and FX markets remain driven by liquidity flows, macro news, and risk sentiment — that combination creates frequent, sharp moves that reward disciplined plan-based trading more than intuition. For Nigerian traders operating with local constraints (payment rails, capital controls, overnight funding) the most practical approach is a rules-based strategy that pairs position-sizing discipline with event-aware risk limits and a small set of high-probability trade setups.

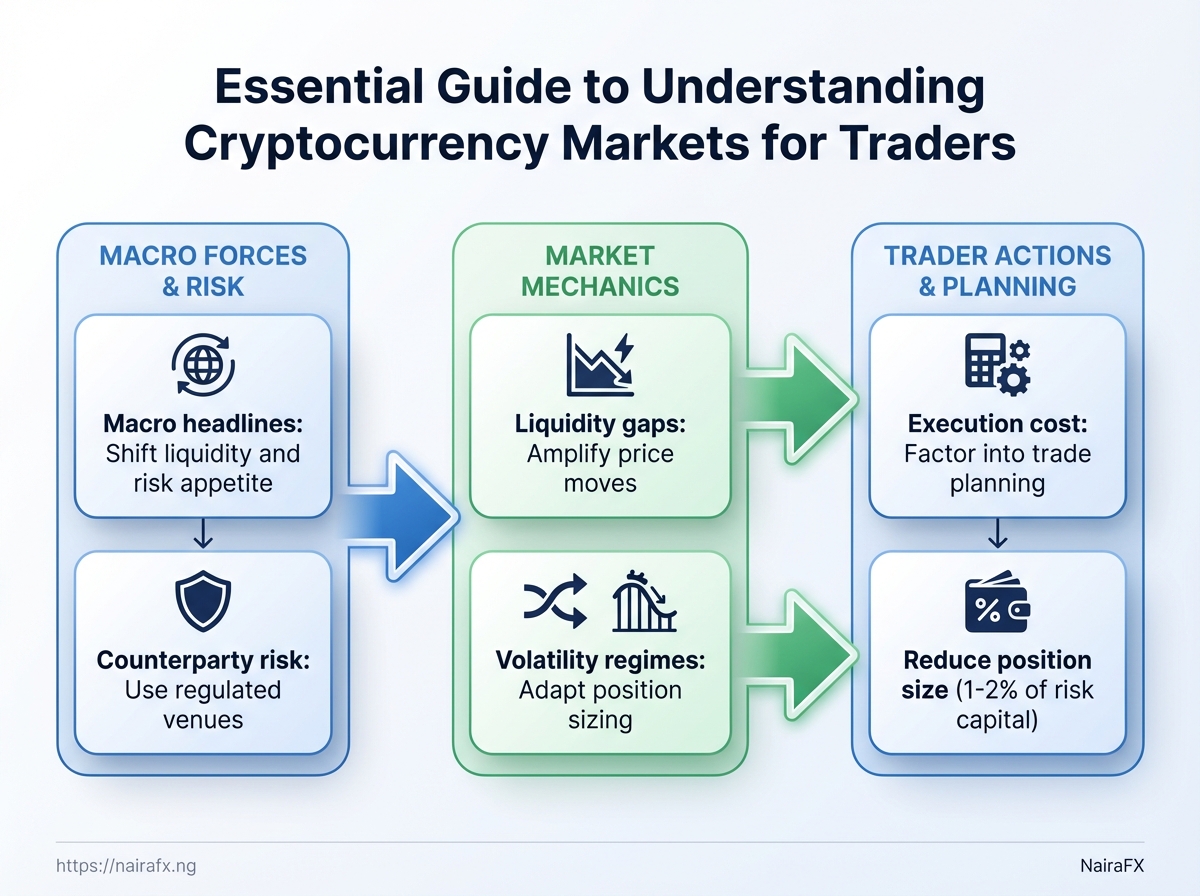

Top market drivers and what to do about them:

- Macro headlines: Central-bank moves and fiscal shocks shift liquidity quickly — trade smaller around scheduled events.

- Liquidity gaps: Thin order books amplify moves — prefer instruments and venues with deep local or onshore liquidity.

- Volatility regimes: Volatility clusters; adapt size when realized volatility increases.

- Execution cost: FX spreads and crypto exchange fees matter — factor them into stop and target placement.

- Counterparty risk: Use regulated venues and clear settlement paths where possible.

Immediate risk-management steps (do these now)

- Reduce position size to a max of 1–2% of the risk capital per trade, using volatility-adjusted sizing.

- Convert stop levels into absolute local-currency risk caps and enforce them at the portfolio level.

- Remove leverage on positions that cross major macro events or show liquidity thinning.

Which trader profiles fit which strategies

- Active scalpers: Benefit from tight micro-structure plays and DMA on liquid pairs; require low latency and tight execution.

- Swing traders: Use trend-following rules with volatility filters and 1–4 week holding windows.

- Position traders: Favor macro-driven carry or mean-reversion strategies sized for drawdown tolerance.

- Hedgers / risk-averse: Blend low-beta instruments and cash overlays; prioritize liquidity and capital preservation.

Practical resources to sharpen execution include the Coursera primer on trading mechanics and the Gemini day-trading guide for strategy basics and trade management details: How to Trade Cryptocurrency: A Practical Guide for … and A Beginner’s Guide to Day Trading Crypto.

This section delivers a clear, actionable framework: trade within volatility, size to surviving drawdowns, and match strategy to your operational constraints. That approach reduces surprises and keeps capital ready for the next high-probability opportunity.

Market Structure and Drivers

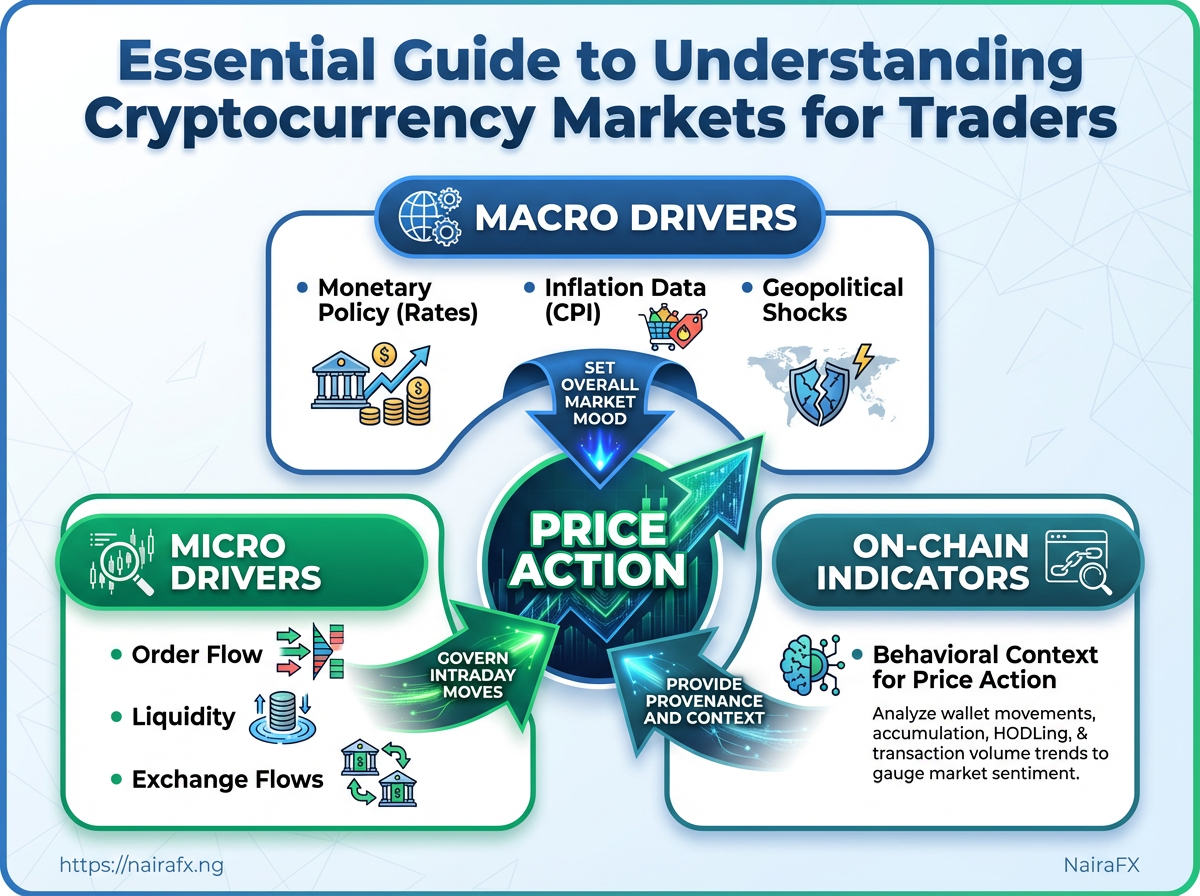

Macro forces set the market’s mood while micro signals and on‑chain metrics tell you how that mood translates into price action. Macro drivers shift overall risk appetite and volatility regimes; micro drivers — order flow, liquidity, exchange flows — govern intraday moves. On‑chain indicators add a layer of provenance: they don’t predict price by themselves but they provide behavioral context that changes how traders interpret micro signals.

Macro drivers: the background rhythm

Macro variables move capital between risk assets and safe havens.Monetary policy (rates): Central bank rate decisions and forward guidance compress or expand risk appetite.

Inflation data / CPI: Surprises raise volatility; real yields often correlate with crypto risk premium.

Geopolitical shocks: Sudden events shift capital flows and liquidity preferences.

Industry resources on how macro context affects trading behavior can be useful when building a macro view, for example How to Trade Cryptocurrency: A Practical Guide.

Micro drivers and liquidity mechanics

Micro factors determine the shape and speed of moves during the trading day.- Order flow: Large aggressive market orders consume liquidity and create slippage.

- Bid-ask liquidity: Thin books amplify the price impact of modest orders.

- Exchange flows: Concentrated withdrawals or deposits change available supply for execution.

Practical daylight: watch trade size / book depth and recent VWAP moves to judge whether the market will absorb your order without moving against you.

On‑chain indicators and practical context

On‑chain metrics reveal who is moving what, and when.Active addresses: A surge can signal renewed user interest but needs coupling with exchange flows to infer selling pressure.

Whale accumulation: Large transfers to cold wallets indicate long-term holding; transfers to exchanges suggest potential selling.

Realized/Spent outputs: Clusters of long-broken dormancy spending often precede volatility.

For day traders, combine on‑chain signals with order‑book evidence rather than treating them as standalone triggers—Gemini’s day‑trading guide highlights pairing technical execution signals with broader data A Beginner’s Guide to Day Trading Crypto.

Map common drivers to indicators and actions

Map common drivers to observable indicators and trader actions for quick reference

| Market Driver | Observable Indicator | Typical Price Effect | Recommended Trader Response |

|---|---|---|---|

| Monetary policy (rates) | Fed/CB statements, rate surprise, yield curve moves | Broad market risk-on/off; directional trends | Reduce leverage pre-announcement; use position sizing and staggered entries |

| Exchange large inflows/outflows | Exchange reserves rising/falling (on-chain + repo reports) | Inflows → potential selling pressure; outflows → reduced sell liquidity | Monitor order book depth; delay large buys into outflow days |

| Protocol upgrade (hard fork) | Git activity, planned block height, social sentiment | Pre-event bid/ask widening; post-event volatility | Scale into positions, use tight stops around release windows |

| Major exchange listing/delisting | Announcement, listing date, volume spikes | Listing → liquidity/price spike; delisting → liquidity drain | Enter small pre-listing trades, scale out on volume spikes |

| On-chain whale accumulation | Large cold-wallet transfers; decrease in exchange reserves | Accumulation often precedes sustained rallies; exchange inflows precede dumps | Validate with exchange flow and order-book behavior before acting |

Combining these layers creates a clearer execution map and reduces surprises during volatile sessions. Trade signals become more actionable when each layer corroborates the others.

Tools, Platforms and Data Sources

For effective trading in volatile markets, toolkit choice shapes outcomes as much as strategy. Use fast, reliable execution platforms for orders, deep analytics for research, and lightweight monitoring tools for positions on the go. Balance speed, cost and data fidelity: low-latency execution often costs more, on-chain analytics can add clarity but needs interpretation, and mobile access trades convenience for some advanced features.

Execution, Analysis, Monitoring

Execution: Match orders quickly with low fees and robust liquidity. Analysis: Charting, on-chain metrics and backtesting engines to validate ideas. Monitoring: Alerts, portfolio apps and mobile UIs to track exposure anywhere.

Practical tradeoffs and tips:

- Speed vs cost: Market-makers and Tier-1 exchanges offer better fills; they charge for lower spreads.

- Accuracy vs accessibility: On-chain datasets (block explorers, Glassnode) are precise but require interpretation; aggregated sites (CoinGecko) are easier for quick scans.

- Mobile accessibility: Mobile-first apps (Binance, MetaMask, TradingView mobile) are fine for monitoring and quick trades; avoid using them for complex order algorithms.

- Start by defining the most important constraint: latency, fees, or data depth.

- Match an execution venue (CEX/DEX) to that constraint.

- Add one analytics tool and one monitoring tool that integrate with your workflow.

Tools across categories so traders can select based on needs and budget

| Tool | Category | Free vs Paid | Best for | Notable Limitation |

|---|---|---|---|---|

| TradingView | Charting & analysis | Free tier; paid plans for indicators | Advanced charting, scripting (Pine Script) |

Higher plans needed for multi-screen/algo work |

| Binance | Centralized exchange (CEX) | Free to use; trading fees apply | High liquidity, spot & futures execution | Regulatory constraints vary by region |

| Uniswap | Decentralized exchange (DEX) | Free to use; gas fees apply | Permissionless token swaps, DeFi liquidity | Gas costs and slippage on low-liquidity pairs |

| Glassnode | On-chain analytics | Free metrics; paid tiers for deep data | Chain-level signals, on-chain indicators | Paid tiers required for advanced datasets |

| CoinGecko | Market data aggregator | Free; enterprise API paid | Quick market snapshots, coin fundamentals | Data lag for some exchanges |

| CoinMarketCap | Market cap & listing data | Free; API tiers paid | Market rankings and historical prices | Listing methodology can skew smaller tokens |

| MetaMask | Wallet & Web3 gateway | Free; transaction fees | Wallet access, DEX interaction from browser/mobile | Not an exchange; user responsible for private keys |

| Coinigy | Multi-exchange terminal | Paid (trial available) | Unified trading across exchanges, portfolio sync | Subscription required for live trading features |

Picking the right mix depends on whether the priority is execution latency, depth of data, or mobility. With a compact, well-integrated toolkit, traders can stay nimble and make faster, more informed decisions in Nigeria’s fast-moving markets.

Trading Strategies and Tactics

Start with the market regime and trade only strategies that fit it. Momentum systems thrive in trending markets; range/mean-reversion works when volatility is low and support/resistance holds; scalping needs deep liquidity. Match timeframe to regime, and set concrete rules that cover entry, exit, position sizing, and maximum portfolio exposure before a single trade executes.

Momentum strategy rule set: Enter after a confirmed breakout above a recent high with volume confirmation. Swing strategy rule set: Enter on pullbacks to a trend-support moving average (e.g., 21 EMA) with a stop-loss below structure. Range/Mean Reversion rule set: Buy near support and sell near resistance with tight stop-loss and target at mid-range. Scalping rule set: Use order-book signals, limit entries, and take-profit within 5–15 pips/ticks. Position/Hedging rule set: Scale-in smaller entries, hedge with correlated assets or options, and use long-term stop-loss distance.

Match strategy to market regime

- Assess regime first: Use ATR and ADX to decide trend vs range.

- Deploy the strategy: Only activate momentum after ADX > 25 and ATR rising.

Risk and portfolio exposure

- Risk per trade: 2% or less of account equity is a reasonable starting point for retail traders.

- Maximum portfolio exposure: No more than 10–20% of total equity exposed to correlated positions at once.

- Position sizing: Convert dollar risk to position size using

position_size = account_risk / (entry - stop).

Execution quality in low-liquidity markets

- Use limit orders: Avoid market orders that suffer slippage in illiquid crypto or small-cap stocks.

- Break large orders into slices: Execute with VWAP or iceberg-style slicing to reduce impact.

- Watch spreads: Widened spreads are a silent cost; require wider targets or skip the trade.

- Backtest rules over multiple regimes and sample sizes.

- Run a Monte Carlo simulation to understand equity curve variability.

- Paper trade live for 30–90 days before scaling.

For day-trading specifics and execution tactics, see the practical day-trading guides like A Beginner’s Guide to Day Trading Crypto and IG’s walkthrough on placing your first crypto trades (https://www.ig.com/en/cryptocurrency-trading/how-to-trade-cryptocurrency). NairaFX’s Monte Carlo service can be used to stress-test these rule sets against realistic sequence risk and drawdowns.

Strategies side-by-side so readers can quickly choose based on timeframe, risk, and required tools

| Strategy | Timeframe | Best Market Condition | Key Indicators | Risk Profile |

|---|---|---|---|---|

| Momentum | Intraday–weeks | Strong trending market | RSI + EMA cross, Volume breakout | High (needs tight stop-loss) |

| Swing | Days–weeks | Trending with periodic pullbacks | 21 EMA, MACD divergence | Medium (structured entries) |

| Range/Mean Reversion | Hours–weeks | Low volatility, clear support/resistance | Bollinger Bands, RSI | Low–Medium (tight targets) |

| Scalping | Seconds–minutes | High liquidity, low spread | Order book, VWAP | High frequency, low per-trade risk |

| Position/Hedging | Months–years | Macro trends, high conviction | Moving averages, macro indicators | Low frequency, larger drawdown tolerance |

Risk Management and Position Sizing

Good risk rules stop one bad trade from wrecking your psychology and your account. Position sizing is the operational tool that turns a risk percentage into a concrete trade size. Use a simple, repeatable formula and guardrails for leverage and execution — that’s how long-term compounding happens instead of emotional roulette.

Position sizing formula and example Use Position Size = (Account Size × Risk%) / Stop Distance% to convert a chosen risk into how much capital to put at stake. Example: with a ₦500,000 account, risking 1% and using a 3% stop, position size = (₦500,000 × 0.01) / 0.03 = ₦166,667.

Risk per trade: A disciplined percentage (commonly 0.5–2%) you’re willing to lose on a single trade. Stop distance: Measured with ATR or a percentage from entry to stop. Use ATR(14) for volatility-aware stops. Leverage: Multiplies both gains and losses; treat leverage as a risk tool, not a profit shortcut.

Leverage and liquidation risk Leverage increases position size without increasing margin, but it narrows the price move that wipes you out. A 10x leveraged long with a 10% margin cushion can be liquidated by a ~9% adverse move after fees. Use lower leverage when volatility is high and widen stops proportionally when you must use leverage. Industry guides on day trading and volatility management are useful for framing practical limits (Gemini day-trading guide, Coursera crypto trading guide).

Pre-trade checklist

- Confirm thesis: trend, level, or catalyst align with the plan.

- Define stop: place a concrete

stop-lossprice tied to ATR or structure.

- Calculate position size using the formula above.

- Verify leverage: ensure margin and worst-case liquidation level.

- Check fees & slippage: estimate execution cost and widen stop if needed.

- Set alerts/orders: use limit/stop orders to avoid manual timing errors.

- Document trade: instrument, entry, stop, size, and rationale.

Provide sample position sizing calculations across account sizes and risk percentages for quick reference

| Account Size | Risk per Trade (%) | Stop Distance (ATR or %) | Position Size (base asset or USD) |

|---|---|---|---|

| ₦100,000 | 1% | 2% | ₦50,000 |

| ₦500,000 | 1% | 3% | ₦166,667 |

| ₦1,000,000 | 2% | 5% | ₦400,000 |

| $1,000 | 1% | 2% | $500 |

| $10,000 | 2% | 5% | $4,000 |

Practical rules to keep: always size to the stop, avoid “eyeballing” position sizes, and reduce risk % when market structure is unclear. These simple disciplines turn volatility from a hazard into a source of opportunity.

Execution, Order Types and Slippage

Execution is where a plan either preserves edge or hands it back to the market. Choosing the right order type and execution tactic isn’t academic — it directly affects fills, realised P&L and the amount of slippage you tolerate. Use limit orders to control price, accept market orders when speed matters more than price, and deploy algorithmic or timed execution for larger size to avoid moving the market.

Limit Order: A directive to buy or sell at a specified price or better. Limits control slippage but may not fill.

Market Order: An instruction to execute immediately at the best available price. Markets guarantee speed, not price — costly in thin or volatile markets.

Stop Order: An order that becomes a market order when a trigger price is hit. Useful for exits but vulnerable to gap moves.

Stop-Limit Order: A stop that becomes a limit order at the trigger. It prevents undesirable fills but risks no execution.

Order type selection and simple tactics

- Always match order type to objective. Use

limitfor entry precision andmarketfor time-sensitive exits. - Consider spread and liquidity. Wider spreads make market orders expensive; low depth increases market impact on larger sizes.

- Use partial fills deliberately. Stagger

limitsizes around key levels rather than one large order that signals to algos.

Execution tactics for different scales

- For small retail-sized trades, prefer

limitorders placed inside the current spread or just beyond reasonable support/resistance.

- For medium trades during normal liquidity, slice the order into 3–5 smaller

limitormarket-aggressive orders spaced over time to reduce signalling.

- For large blocks, use algorithmic execution (TWAP/VWAP/POV) or time-weighted slicing to blend into market flow and control impact.

- For stop placement, avoid clustering stops at obvious round numbers; use volatility-based distances such as multiples of ATR.

Real examples and testing

- Example — aggressive exit: During a fast market drop, a

marketstop exit executed immediately but at a price 1.5x the spread, turning a small loss into a larger slippage cost. - Example — patient entry: A

limitentry at a liquidity shelf filled later with minimal slippage and better position sizing.

Modelling slippage helps. Run simulations or Monte Carlo scenarios to see how fills under different volatility regimes change expected returns — this is especially useful for position-sizing and risk models.

Being deliberate about order types and execution tactics saves money and preserves strategy edge in real trading conditions. Choose the tool that matches the trade, and test fills under live-like conditions so execution becomes an advantage, not an afterthought.

Regulation, Taxes and Compliance (with focus on Nigeria)

Cryptocurrency trading sits in a grey regulatory space in Nigeria, so treat compliance as an active part of the trading process rather than an afterthought. Keep exhaustive, auditable records, verify the licensing and KYC posture of any counterparty, and get local tax advice early — these actions reduce legal and financial friction and make audits or disputes survivable.

Regulatory posture in Nigeria

- Central bank guidance: The Central Bank of Nigeria has repeatedly issued advisories restricting banks’ direct facilitation of crypto transactions; however, peer-to-peer and offshore exchange use remains common.

- Enforcement trend: Regulators are increasingly concerned with AML/CFT (anti-money laundering / counter financing of terrorism) compliance and traceability.

Practical record-keeping and tax preparation

Practical record-keeping steps

- Create a single, exportable trade ledger and export it monthly.

- Record each trade on its own line with date/time, exchange, pair, direction (buy/sell),

quantity, price, fees, and resulting wallet used.

- Export and store exchange statements and on-chain transaction histories (CSV/JSON) in a secure folder with versioned backups.

- Tag transfers between your own wallets clearly (internal transfer vs. disposal).

- Reconcile on-chain transaction IDs (

txid) with exchange entries and include screenshots of large orders or suspicious events.

s for quick reference

Trade ledger: A CSV/Excel file with one row per executed order, including timestamps, pair, size, price, fees, and counterparty/exchange.

Wallet history: On-chain list of transactions associated with a wallet address, exported from a block explorer or node.

Internal transfer: Movement of crypto between wallets owned by the same person; should be documented to avoid double-counting taxable events.

Compliance checks when choosing providers

- Verify licensing: Check whether the exchange is licensed where it operates and whether it enforces KYC/AML.

- KYC strictness: Prefer providers that require identity verification and provide transaction history exports.

- Fee transparency: Ensure fee lines are explicit in reports to avoid reconciliation gaps.

When to involve professionals

- Complex situations: Large gains, cross-border income, or corporate trading require a tax lawyer or accountant familiar with Nigerian tax law.

- Audits or notices: Immediately gather ledger exports and professional representation.

Good record-keeping and early professional advice turn regulatory uncertainty into manageable operational processes; that’s the practical edge every active Nigerian trader needs.

Quick Reference / Cheat Sheet

Start here when markets get noisy: compact, printable rules you can read at a glance before sizing a trade, running through indicators or doing a final pre-trade sanity check.

Position sizing (ready-to-print)

UsePosition Size = (Account Risk % Account Size) / Stop Distance

- Example: With ₦500,000 account and 1% risk per trade,

Account Risk = 0.01. If stop = 200 pips,Position Size = (0.01 500000) / 200 = ₦25per pip. - Practical tip: Convert pips to monetary value per unit of the instrument before placing the order. For forex pairs quoted with lots, map pip value to lot size.

Top indicators + suggested settings

- EMA trend filter: 50 EMA (trend) and 200 EMA (structure) — trade with the 50 above 200 for longs, below for shorts.

- Momentum confirmation: 14-period RSI — look for divergence or RSI crossing 50 for confirmation.

- Volatility sizing: 20-period ATR — set stops at

1.5–2.5 * ATRfor swing trades, tighter for intraday. - Volume / order flow: On-chart volume or OBV — confirm move strength before committing.

- Support/resistance: Price action zones drawn from daily/4H — prioritize multi-timeframe confluence.

For more on day-trading setups and indicator uses, see A Beginner’s Guide to Day Trading Crypto.

Pre-trade checklist (run this every time)

- Confirm liquidity: spread acceptable and market depth adequate.

- Check scheduled news: avoid placing new positions within high-impact releases unless strategy covers it.

- Correlation scan: ensure no hidden exposure to the same underlying (e.g., EURUSD and a euro equity ETF).

- Risk math: calculate position size with the formula above and verify maximum portfolio drawdown if it hits stop.

- Order type & execution: choose market vs. limit, set stop and take-profit, and test slippage assumptions.

Definitions

Account Risk %: Portion of account you’re willing to lose on a single trade.

Stop Distance: Distance from entry to stop in price units (pips, ticks, points).

Include a printed copy of this sheet at your desk; it cuts hesitation and enforces discipline when screens get loud. Trust the checklist to keep trades mechanical and repeatable — the human job is execution, not improvisation.

FAQ

Most questions traders ask come back to three things: protecting capital, setting a repeatable process, and adapting to fast-moving markets. Below are the common questions Nigerian retail traders raise, with direct, actionable answers and pointers to deeper material.

What’s the simplest way to limit losses without missing trades?

- Use a

stop-lossevery trade. Place it where your edge breaks, not at round numbers. - Combine position-sizing with stops. Risk a fixed percentage of equity per trade (commonly 0.5–2%).

How do I start day trading crypto or forex with minimal experience?

- Open a demo account and trade at least 30–60 sessions to learn order flow.

- Focus on one market and one time frame.

- Build a simple playbook: entry, stop, target, exit rules, and review process.

Which indicators actually help, and which are crowd noise?

- Momentum indicators: good for trend strength and timing.

- Volume-based tools: often reveal real participation.

- Lagging moving averages: useful for trend confirmation, not precise entries.

How do I handle market volatility driven by local news or FX shocks?

- Tighten position sizing before expected events.

- Use wider

stop-lossonly if the trade’s edge justifies it. - Avoid illiquid hours on local exchanges; trade larger sessions for better fills.

What common mistakes cost new traders most?

- Overtrading: too many low-quality setups.

- Poor risk control: risking large chunks of capital.

- No review process: failing to learn from losing streaks.

Where should I keep learning resources?

- Operational manuals: keep a concise trading plan document.

- Journal: record trade rationale and outcome.

- Continuing education: follow reputable guides like IG’s beginner walkthrough: How to Trade Cryptocurrency: A Beginners Guide – IG

This FAQ should leave the most urgent friction points clearer and actionable. Treat these answers as practical habits to test and refine against real market data rather than fixed doctrines.

Resources and Further Reading

For fast access to market data, on-chain signals, technical analysis, and learning materials, these curated resources match different stages of a trader’s path — from researching a coin to stress-testing a strategy. Below are practical use-cases and cost notes so a trader in Nigeria can pick tools that fit capital, time horizon, and technical depth.

- Market data & price aggregation: Use for watchlists, market caps, and screens (free and paid tiers available).

- On-chain analytics: Use when validating network health or whale activity (mostly freemium with advanced paid tiers).

- Charting & technical tools: Use for multi-timeframe analysis and alerts (free plans exist; paid unlocks backtesting and alerts).

- Exchanges & execution: Use for liquidity, order types, and API execution (typically free to join; fees per trade apply).

- Security & verification: Use for smart-contract audits and token legitimacy checks (paid audits; explorers are free).

- Education & strategy: Use structured courses and practical guides — good starting points include Coursera’s practical guide and Gemini’s day-trading primer (Coursera article on trading crypto, Gemini day-trading guide).

Organize recommended tools and references by category for fast selection

| Resource | Category | Free/Paid | Best for |

|---|---|---|---|

| TradingView | Charting & alerts | Free tier / Paid from $14.95/mo | Technical analysis, custom indicators |

| Glassnode | On-chain analytics | Freemium / Paid from ~$39/mo | Chain metrics, supply/flow analysis |

| CoinGecko | Market aggregator | Free | Token info, liquidity, simple screens |

| Binance | Exchange & execution | Free to join (trading fees apply) | High liquidity, spot & futures trading |

| CertiK | Smart-contract audits | Paid services | Security audits, formal verification |

| Etherscan | Blockchain explorer | Free | Transaction tracing, contract verification |

| CoinMarketCap | Market data & listings | Free / API paid tiers | Global rankings, historical data |

| Messari | Research & datasets | Freemium / Paid | Deep research, token profiles |

| 3Commas | Trade automation | Paid (trial available) | Bots, copy-trading, portfolio automation |

| TokenMetrics | Strategy & analytics | Paid subscriptions | Quant ratings, model-driven picks |

Further reading that bridges practical trading and risk management includes IG’s beginner guide to trading mechanics (IG beginner guide) and the Blockchain Council overview for newcomers (Blockchain Council guide). Use these when building checklists and rule-based strategies before allocating real capital.

Choose a small set of tools and discipline their use: fewer sources, well-understood signals, and routine verification beat tool-hopping every week.

Conclusion and Next Steps

Start by turning ideas into a repeatable, testable process: trade a clear plan on paper, then scale to a small live size once the edge shows up consistently. That discipline separates hopeful guesses from a manageable trading approach that can be refined and scaled.

- Immediate actions: Open a dedicated demo or micro account and run the strategy for a minimum of 30 trades or 60 calendar days.

- Test with intent: Use

Monte Carlostyle distortions when simulating results to see how sensitive the strategy is to streaks and drawdown sequences. - Record keeping: Keep a timestamped trade log with rationale, entry/exit rules, position size, and emotional state for each trade.

- Compliance reminder: Keep separate records for tax reporting and local regulatory checks; accurate logs make audits far less painful.

- Iterate quickly: Turn observations into rule changes, then re-test those rules on the same demo stream before touching real capital.

- Decide your acceptance criteria for moving from demo to live (for example: minimum 60 trades, Sharpe-like measure stable, drawdown below X%).

- Fund a micro-sized live account and trade only a fixed fraction of the demo position size while you validate slippage and execution quality.

- Run

Monte Carlosimulations and sanity-check equity-curve behaviour; if outcomes frequently cross unacceptable drawdowns, pause and reassess.

Practical example: run a trend-following FX setup on a demo account for two months, log every trade, then run 1,000 Monte Carlo resamples to see the distribution of maximum drawdown. If the 95th percentile drawdown is acceptable, increase to micro-live; otherwise, tighten stops or reduce position size.

Using structured tools speeds this work. The practical guides at Coursera on how to trade cryptocurrency and Gemini’s day trading primer are useful for baseline methodology and execution hygiene. For traders wanting deeper risk-analysis, Monte Carlo simulations and equity-curve evaluation are available as services at NairaFX, which can plug directly into your history to produce validity reports.

Follow the plan, keep precise records, and treat each iteration as an experiment — that approach turns volatility from threat into useful feedback. Keep trading in small, controlled steps until the process proves itself.

Conclusion

You’ve seen how price action, on‑chain signals and local news combine to move crypto — and why trading without a clear edge feels like guessing. Remember the volatility examples earlier: momentum plays that worked during bullish runs, and the risk controls that limited losses during the Lagos exchange outage. Combine rigorous position sizing, consistent execution rules, and a watchlist tied to on‑chain and sentiment triggers to stop reacting and start trading with intention. If tax treatment or exchange licensing in Nigeria felt murky, know that following documented recordkeeping and using regulated platforms reduces both regulatory and execution risk.

Next practical steps: build a two‑week replay routine, backtest one strategy on historical candles, and set a hard daily loss limit before you trade live. For step‑by‑step implementation and local regulatory guidance, consult resources like How to Trade Cryptocurrency: A Practical Guide for Beginners and consider professional assistance from services such as NairaFX for market data and execution tools tailored to Nigerian traders. If questions remain about position sizing, tax reporting, or choosing an execution venue, revisit the Risk Management and Regulation sections — the answers are there and built to be applied. Start small, keep records, and treat each trade as an experiment with measurable rules.